Advertisement

Savvy Spending with Nicole Lapin

Here’s how to make money moves in 2020, according to our fave financial pro

Nicole Lapin wasn’t always a master of all things money.

Growing up in a family that never spoke about finances and attending a school that didn’t include financial education, she had no sense of dollars and cents. When she found herself working on the floor of the Chicago Mercantile Exchange as a rookie financial reporter at age 18, it was pure “fake it till you make it.”

“I just lied,” says Lapin. “I said I knew about finance … and discovered that money is just a language like everything else; we just don’t have a Rosetta Stone. Once I discovered how to speak the language, I spoke it to the world*—and fast-forward to a decade later: I launched The Money School.”

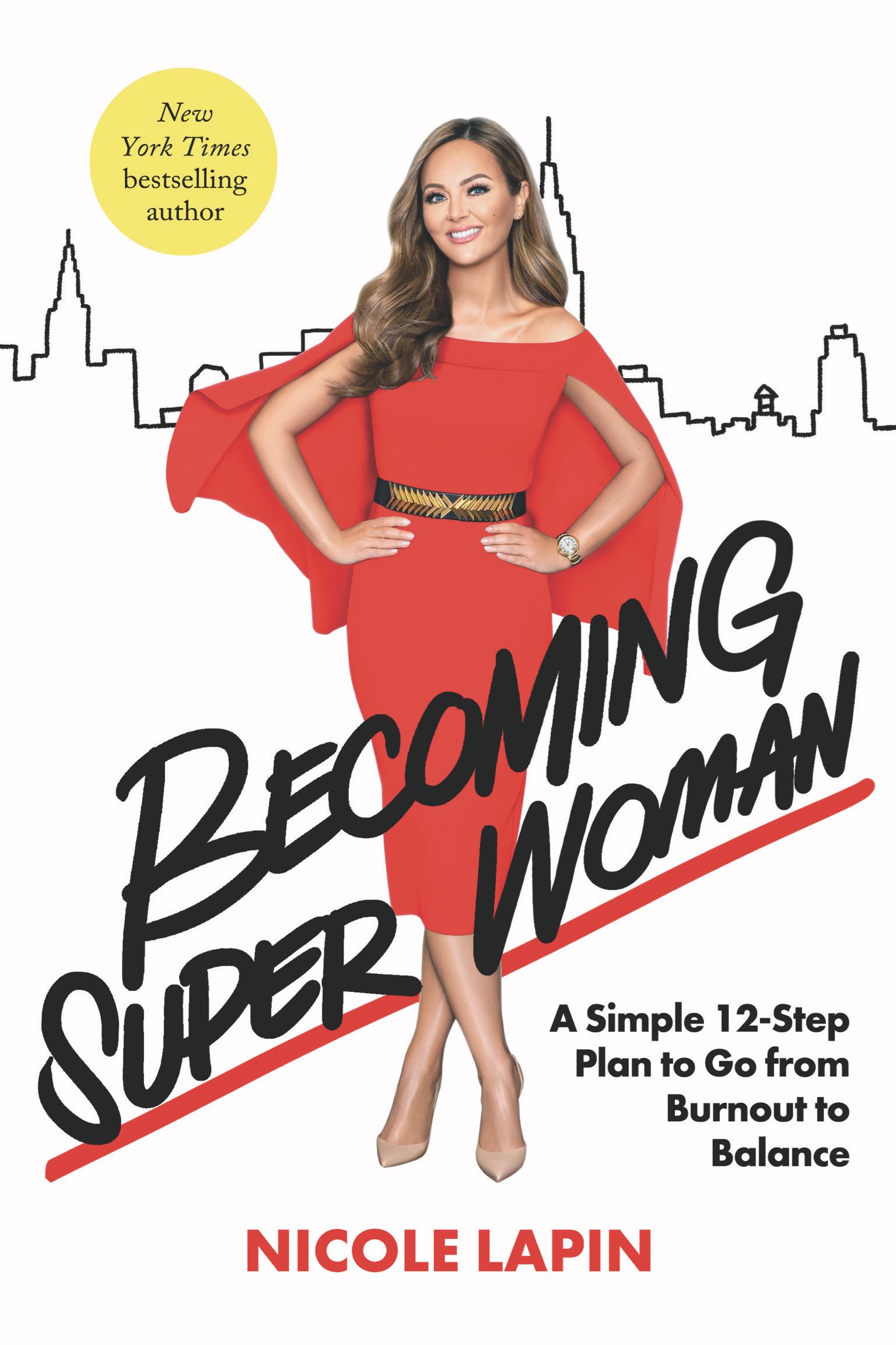

In addition to running The Money School—a three-month online course that covers all your financial bases to get your cash flow on track—Lapin is a New York Times best-selling author. She’s written Rich Bitch, Boss Bitch, and, most recently, Becoming Super Woman. She’s also a speaker and co-host of the personal finances-focused podcast Hush Money. Breaking down the financial language barrier is what she’s famed for. She frames money topics in a friend-to-friend fashion, complete with no-bullshit quips and straight-shooting, actionable tips.

In addition to running The Money School—a three-month online course that covers all your financial bases to get your cash flow on track—Lapin is a New York Times best-selling author. She’s written Rich Bitch, Boss Bitch, and, most recently, Becoming Super Woman. She’s also a speaker and co-host of the personal finances-focused podcast Hush Money. Breaking down the financial language barrier is what she’s famed for. She frames money topics in a friend-to-friend fashion, complete with no-bullshit quips and straight-shooting, actionable tips.

“Once you can speak the language, obstacles like guilt, shame, and other emotions that come along with an overwhelming and intimidating topic melt away,” says Lapin.

*Just how did Nicole Lapin start teaching the world about money? She became the youngest anchor at CNN and then at CNBC, for starters.

Financial stress may be one of the worst heart-health villains! Stress has long been linked to heart disease, but now researchers have shown that different types of stress may have different degrees of impact on your health. In a recent study, participants with moderate to high financial stress were nearly three times as likely to have a heart disease event. In another study—this one examining links between heart attacks and depression, anxiety, stress, work stress, and financial stress—researchers found that people with significant financial stress were 13 times more likely to have a heart attack. (Meanwhile, those with major work stress were 5.6 times more likely to have a heart attack.) Time to take your financial health to heart!

Advertisement

The big picture

There are a few fundamental shifts most people need to make to start feeling good about their finances and their level of success, says Lapin.

Start from where you are

A lot of people think they have to make money before they can take control of it—but according to Lapin, there’s no time like the present to start dealing with your finances (or anything else, for that matter).

“There’s this idea that we’ll be happy when we get to a certain job or a certain salary or when we lose five pounds,” explains Lapin. “But the five pounds becomes 10 pounds, the salary becomes a bigger one, and we never get our brain to the other side.”

Change your mindset: You are “there” right now. Sure, there’s always going to be another step to take or target to aim for, but, as Lapin says, “Studies have shown that balance, happiness, and getting your financial shit together will bring you more success and wealth than having it the other way around.”

Set your own benchmark and stick to it

If you feel off-balance, like your budget is out of whack, or that you just aren’t succeeding, ask yourself if you actually have a definition of what balance, success, or financial security is for you. Lapin’s advice? Get real.

“If we constantly compare ourselves to whatever is happening on Instagram, we just assume that we’re not balanced compared to the best version being shown,” she says. “Comparing our mom lives to that of a mommy blogger who bakes bread and homeschools her kids or our fitness regimen to that of a fitness blogger who works out for five hours a day is just not realistic. Coming up with a benchmark for yourself and not changing the goalposts is the best way to tackle that.”

Of course, there are more specific steps you can take to really own your financial health once you’ve made the necessary mental shifts.

Advertisement

Nicole Lapin’s tips for financial wellness in 2020

1. Make a spending plan

Break your income down into Essentials, Endgame, and Extras. “It’s a good way to look at your finances as a whole and still allow yourself small indulgences so you don’t end up binging later on,” says Lapin.

2. Negotiate

Everything is worth questioning. Ask for a better deal on your interest rate on your credit card, your major bills, mortgage—everything. The worst that can happen is that your payments will stay the same.

3. Prioritize to pulverize

Any debt you might have needs to be ranked. The debts with the highest interest rates need to go first. Think credit card debt, followed by your car loan, then your mortgage, and finally your student loans.

4. Be prepared

Tailor your savings to things that are personal to you—and automate saving so a certain amount is put away every month without you thinking about it. For example, “I break my phone once or twice a year,” says Lapin, “so putting a certain amount of money into a fund for when it inevitably happens really lessens the anxiety around it happening.”

5. Self-investment is the new self-care

Lapin’s latest book, Becoming Super Woman, is all about avoiding burnout and achieving balance. To write it, she explored pretty much every aspect of self-care. “Rather than pedicures or massages—although I do love those—I like to think of self-care as the work you do on yourself, for yourself,” says Lapin. And that work doesn’t have to break the bank. Sometimes it can actually give you a pay raise!

6. Take a mental health day

If you’re feeling anxious or on edge, can’t sleep, can’t perk up, or have been constantly sick lately, it might be time to take a day for your mental health. Talking about the need for these openly will help to end the stigma around them. If you feel like you just can’t afford it, remember that taking a sick day is included in your wage—and the more days off you take, the higher your hourly pay becomes.

Laura Sugden is a health coach whose savings pots include “Far-off lands,” “Bright lights + city nights,” and “Expensive haircuts.” There’s also “New house,” but we don’t talk about that. @free.bird.living; freebirdliving.org

A version of this article was originally published in the January/February issue of alive USA with the title “Savvy Spending with Nicole Lapin.”